AMTD

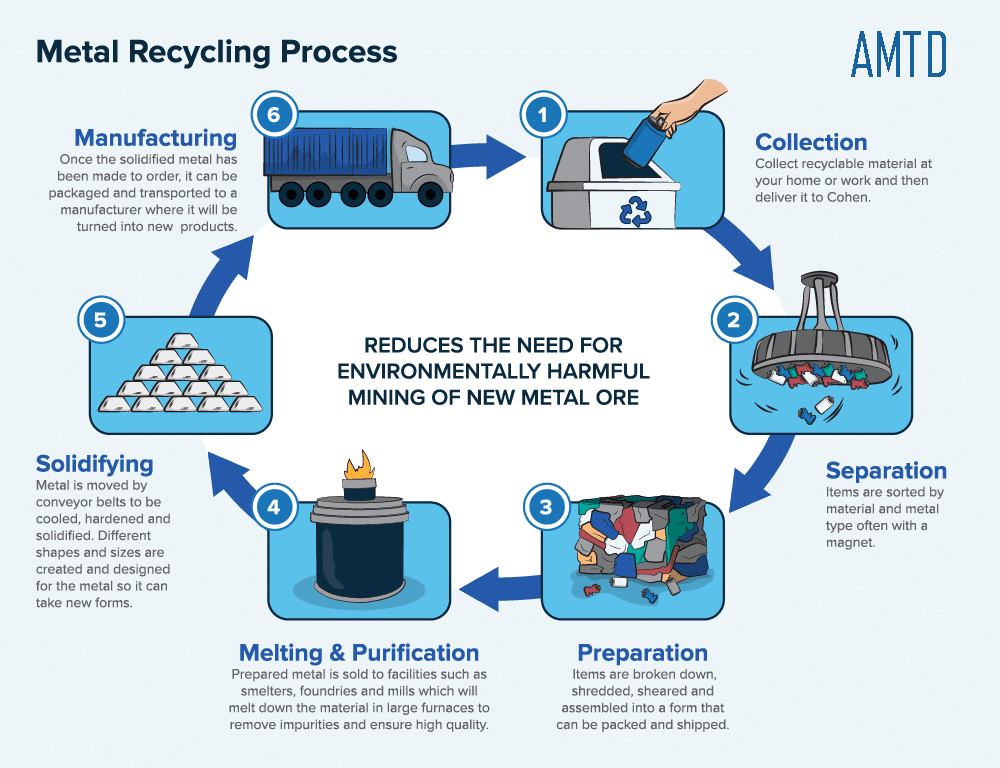

Renewable Resource Recycling

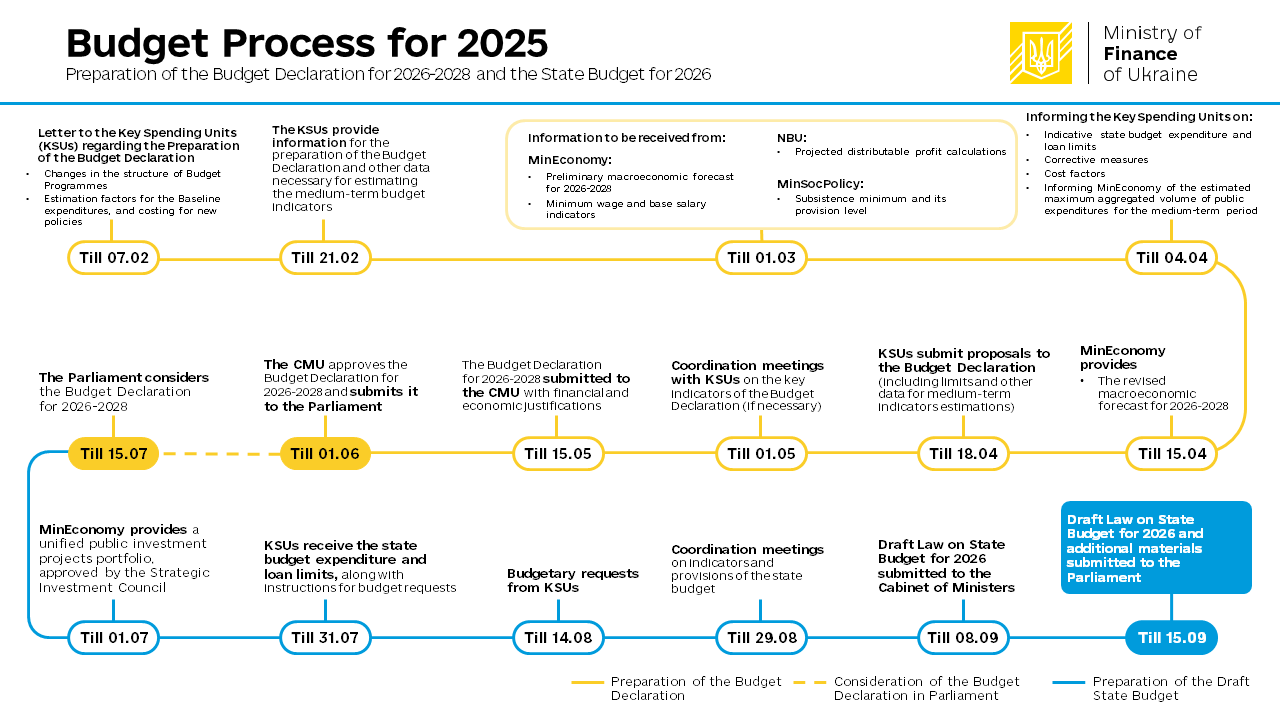

The Ukraine 2026-2028 budget outlines a strategic roadmap for the scrap metal industry and circular economy advancement. Released on June 27, 2025, the fiscal plan introduces vital tax reforms, sustainability-focused investments, and a comprehensive green shift across infrastructure and industrial sectors, aimed at supporting post-war recovery and long-term economic resilience.

Amid post-war reconstruction, Ukraine is redirecting public funds to support green development and sustainable growth. The 2026-2028 fiscal plan emphasizes transparency, investment in environmental infrastructure, and long-term public-private collaboration. This creates new opportunities for green-focused enterprises like AMTDSCRAP to contribute to national rebuilding efforts.

According to recent government reports, Ukraine’s scrap metal industry is expected to grow at an annual rate of 8–10% between 2026 and 2028. The country aims to process over 1.5 million tons of scrap metal annually by 2028, driven by extensive reconstruction projects and rising export demand. Private investors and companies like AMTDSCRAP are positioned to capitalize on this growth through certified recycling operations and sustainable sourcing.

The new fiscal plan introduces digital enforcement tools and tax transparency measures to curb informal market activity. As a result, Ukraine’s scrap metal industry will likely consolidate around licensed, tax-compliant operators, enhancing market fairness, governance, and foreign investor confidence.

Significant budget allocations will upgrade urban waste systems, modernize recycling centers, and improve regional ecological services. These reforms strengthen Ukraine’s long-term commitment to scrap metal recycling and green urban development. The government actively encourages private-sector participation in these initiatives.

Ukraine’s pivot toward a circular economy aligns with the EU Green Deal and growing global ESG (Environmental, Social, and Governance) investing trends. For recyclers and investors, this means stronger compliance frameworks, long-term market viability, and policy momentum to scale green operations across Europe and beyond.